SSR Research: 2025 Midyear Report

“And once the storm is over, you won’t remember how you made it through, how you managed to survive. You won’t even be sure, whether the storm is really over. But one thing is certain. When you come out of the storm, you won’t be the same person who walked in. That’s what this storm’s all about.” – Haruki Murakami, from Kafka on the Shore.

The first half of 2025 felt like more than just a storm; there were moments when we truly questioned if we’d make it through. But survive we did. If you ask me if the storm is over? I don’t know. But are we better aware of possibilities of such storms, yes we are, and that’s what a storm does.

Even robust strategies like trend following, which weathered the global uncertainty with some resilience, faced a tough time in May. I am told it was a global phenomena, the bad patch i.e.

With that said, let’s dive into how the strategies & portfolios performed in the first half of 2025.

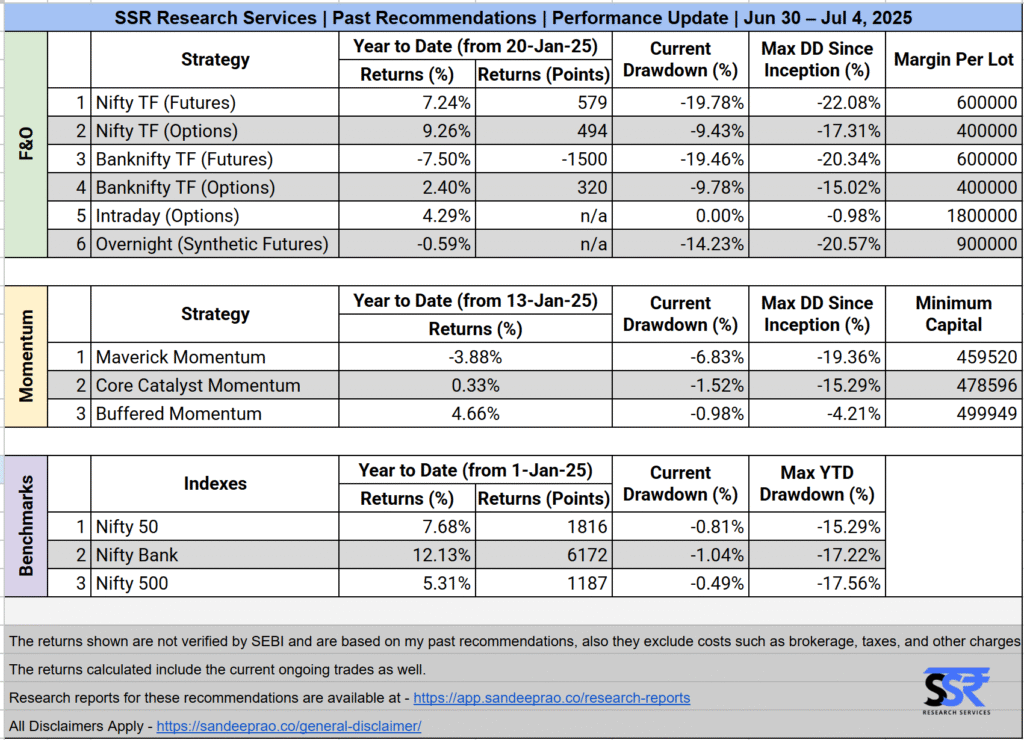

F&O Strategies: Mixed Bag, Some hits, more misses

Our flagship Nifty trend following strategy delivered solid results, closing with nearly 7% on futures and 9% on options. However, Banknifty trend following had a very bad performance, finishing at -7.5% on futures and 2.4% on options.

Intraday option selling continues to be a steady performer, chugging along with close to 4% returns on an under 1% drawdown. It a good way to add a layer of short volatility alpha on top of your existing investments.

After a phenomenal first quarter, our Overnight strategies took a hit in the second quarter. They are just now beginning to recover from a drawdown.

Equity Portfolios: Emerging from the Storm

Moving over to the equity side, our buffered momentum portfolio, which incorporates a trend-following layer to avoid adding positions during downtrends, is performing quite well. The Core Catalyst Momentum portfolio, focusing on large and mid-cap stocks, is also out of its drawdown. Our Maverick momentum strategy is making its way out of a drawdown too, though it still has some ground to cover.

For your convenience, we’ve recently launched all these equity portfolios on Smallcase, offering the ease of single-click execution if you’d like to explore them.

That pretty much sums up the performance of the first half of the year. It wasn’t the best, but as I said, survival was key, and I believe we achieved that. As a quant and the designer of these strategies and portfolios, I’m confident in their underlying strength. To borrow from Iqbal:

Nahi hai na-ummid Iqbal, apni kisht-e-viraan se, Zara nam ho toh ye mitti bahut zarkhez hai saki.

This translates to: Iqbal has not lost hope about his barren land, if it gets a little water, this soil is very fertile, o saki.

So, I truly believe our strategies are quite “fertile”; it’s just a matter of enduring the dry spell, and waiting for it to rain a bit.

That’s all for this post people. If you have any questions or need clarifications about any of our F&O Models or Smallcase Portfolios, please feel free to reach out to me at info@sandeeprao.co. I’d be more than happy to answer them.

Until then, trade and invest safely.

I am on X @mysandz follow me for the latest blog updates. If you are serious about systematic quant based investing or trading explore our subscription plans here.

Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BSE and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.