SSR Nifty 750 Midas Momentum Model

How It Works

This strategy is momentum investing, but with a gold hedge. We maintain a constant 30% allocation to gold and 70% to equity. That’s it. When these allocations deviate from the 70-30 split, we bring them back to their original levels once a month or two at most.

For the equity part, it’s precisely like the buffered momentum strategy I’ve written about before – same trend-following filters, same weekly Thursday reviews with Friday execution. The only difference? We pick 25 stocks instead of 30.

The gold allocation is our insurance policy, sort of. While stocks are doing their thing, gold is usually doing something completely different. That’s why its a great addition to any portfolio.

Why Gold?

Because it serves as a hedge both to equity and inflation for us in India. Do check this paper by Raju Ranjan, Long-Term Asset Returns in India: A Historical Survey (1992-2024)

This strategy lives and dies by two things: how well our equity picks do, and how gold performs. That 30% gold allocation isn’t just sitting there looking pretty – it’s actively affecting your returns.

The good thing? When equity markets crash, gold often holds steady or even rises. It’s that non-correlated hedge that can save your portfolio when everything else is falling apart. The buffered equity component already has some protection built in, and now you’ve got gold as an extra layer.

The bad news? Gold has been on an excellent run for the past 15 years, primarily due to the consistent weakening of the rupee. But we don’t know if this one-sided INR depreciation will continue forever. If gold starts underperforming for years, this strategy will feel that pain.

The drawdowns have been 25-30%, which means if you had 100 rupees, it would have become 70-75 rupees at the worst point. That’s quite impressive, considering you’re earning 20-23% annual returns over 18 years.

What’s interesting is that, even though we’re dedicating 30% to gold (which historically yields lower returns than equity), we’re still achieving solid overall performance. That’s the magic of rebalancing and the power of having uncorrelated assets.

Who Should Consider This?

If you want momentum-based equity returns but with a built-in hedge, this could be your strategy. It’s for people who like the idea of momentum investing but want some insurance against those inevitable equity crashes.

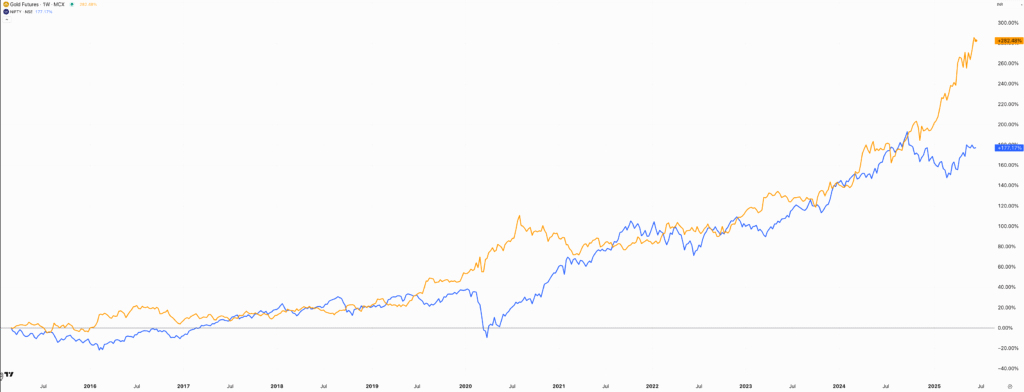

This is a chart of Nifty and Gold over the past decade,

However, remember that you’re betting on both equity momentum and gold performance. If you think gold is going to have a rough decade, this strategy will disappoint you.

Conclusion

This strategy is effective if you believe in the power of diversification and non-correlated assets. The 20-23% returns with 25-30% drawdowns show that adding gold to a momentum equity strategy can actually improve your risk-adjusted returns.

The monthly rebalancing between gold and equity is crucial – it forces you to sell what’s doing poorly and buy what’s doing well, which is precisely what good investors should do but rarely have the discipline to execute.

But I’ll be honest – I have confidence that gold will continue to provide good non-correlated returns when equity is down. If I’m wrong about that, this strategy won’t age well. But if I’m right, you’ll have a smoother ride than pure equity momentum strategies while still capturing most of the upside.

It’s the “belt and suspenders” approach to momentum investing – you get the growth potential of momentum stocks with the stability of gold as your safety net.

How to invest?

Click on “View smallcase” button and follow through.

Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BSE and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Reach out to us at info@sandeeprao.co for any clarifications.